Beer Marketer's Insights

OBIT: Indian Industrialist Ratan Tata, Who Won Quick Vitaminwater Jackpot, Passes Away at Age 86

Ratan Tata, swashbuckling dealmaker who built Tata Group into diverse industrial powerhouse in India, passed away of natural causes at age 86. Tho his interests spanned steel, autos and financial services, the Cornell-educated tycoon also played in food/bev, including via acquisition of Britain's venerable Tetley tea maker in 2000 for $432 mil. He famously made a quick killing on Vitaminwater marketer Glaceau in purchasing a 30% stake for $677 mil in 2006, then seeing co exit to Coke for $4.1 bil a year later. (At the time, Glaceau prexy Mike Repole termed the alliance "really good news for our employees, distributors and retailers" because "this partnership ensures our continued independence." Then Coca-Cola came along with outsize offer.) Among his more audacious pickups were two of Britain's most revered car brands, British Jaguar and Land Rover, then owned by Ford. In India, news of Tata's death "prompted an outpouring of grief by everyone from politicians to business tycoons and Bollywood stars," the Guardian reported. "The Maharastra state government announced a day of mourning and said his last rites would be performed with full state honors."

Blue Triton, the relatively new co comprised mainly of old Nestle Waters North America, is latest legacy bottled water player to start weaving cans increasingly into its mix. We spotted a coupla such moves at NACS display. For one, bottled Splash flavored still water will be augmented in Jan by 16-oz canned line of Splash Sparkling items that will go out at accessible $1.49 SRP to offer more affordable alternative to canned brands like Liquid Death. In cents per ounce, that frontline equates to Diet Coke in C&G channel, noted brand mgr Mike Thiel. The sucralose-sweetened entries contain no calories but are fortified with electrolytes, in a clear liquid in contrast to brands like Sparkling Ice. Initial flavors are Rocket Freeze, Blood Orange and Kiwi Watermelon. Those entries also are being offered in 8-pks of 12-oz cans, along with a Black Cherry flavor offered only in that multipack format. The core still line, which does well in club, mass and grocery channels, remains only a PET-bottle brand, Mike said.

Nestle SA's Perrier water, which just settled a case in France "alleging it committed fraud by filtering its water, using methods that are illegal in France for mineral waters," now faces possible contamination issues, reported Bloomberg. At one of 7 wells used by Perrier in the country, traces of "fecal matter" were found this past April, resulting in destruction of 2 mil bottles. Report notes too that a "heavily redacted" regulator report from 2023 seen by Bloomberg "showed that traces of pesticides banned over two decades ago and linked to cancer were found in the water where Perrier is sourced." A consumer watchdog group called Foodwatch has now filed a lawsuit against co which claims settlement last month allowed Nestle Waters France to "bury the case." Meanwhile, Nestle execs continue to reaffirm Perrier water is safe to drink. "Our operating conditions are becoming more difficult, especially due to the environmental challenges linked to climate change, with more heavy rains and droughts that are becoming more frequent and more intense," said Sophie Dubois, gm of Nestle Waters France. But she assured that co has taken steps "to ensure perfect hygiene and food safety."

Legal fracas between Mark Anthony Brands' Mas+ by Messi sports drink and Prime Hydration is continuing, with Mark Anthony now seeking a declaratory judgment that the Messi package design does not infringe on Prime. The suit filed Tues claims that Prime "reached out to the drink distributors shortly after launch with a demand that they cease sales of Mas+ by Messi until they change the packaging," as Dexerto reported. "The distributor also claims that Prime has threatened to sue for trademark and trade dress infringement." The Messi launch sent Prime loyalists into a frenzy of indignation, claiming their beloved brand had been ripped off, and Prime operator Congo Brands is known for trying to wield severe restrictions on rival brands that can be carried by wholesalers of its Prime and Alani Nu Energy brands. Mark Anthony's action argues that Prime is "seeking not only to prevent fair competition but also is trying to monopolize functional packaging elements that are commonplace in the hydration beverage industry." And in what seems both a gibe and a legal argument, Mark Anthony suit makes an argument that Prime gets ample differentiation vs rivals like Mas+ by Messi by virtue of its creator Logan Paul being embroiled in "many highly publicized scandals since his emergence as a YouTube influencer. Because of these controversies and other public stunts, the public understands who Logan Paul is, and it can easily distinguish him and his business partners from Mr Messi," suit states. These have included "publishing a vlog making light of Japan's Aokigahara" and "failing to release" a promised crypto video game called CryptoZoo.

Stevia bev marketer Zevia continues to get encouragement on its DSD initiative, seeing velocities accelerate in its first such market, the Pac NW, with Calif next in co's sights. Zevia led by Amy Taylor and several other ex-Red Bull execs had enlisted Columbia Distributing, a longtime Red Bull partner, as its first anchor DSD house, also enlisting Hayden in Idaho and Bill's in Alaska to flesh out Albertsons/Safeway footprint for region (BBI, May 8). That's been vindicated 90 days in by pop in velocity at cutover grocers like Albertson's Seattle units, said svp sales/chief commercial officer Fredo Guarino. The move also has helped the longtime grocery mainstay start to build a presence in c-stores, with new distribs landing indie operators and pitching regional chains now, with new 12-oz sleek cans a key lure compared to conventional 12-oz cans Zevia has long sold in multipacks in grocers. Guarino credited his post-Red Bull stint at Anheuser-Busch with teaching him that grocers' divisional boundaries may matter more than state lines in building out a DSD network, as reflected in initial trio of partners. He's now working to find right partners in Calif. As for NACS exhibit, co was sampling ecomm-only Salted Caramel flavor that's proved a solid hit.

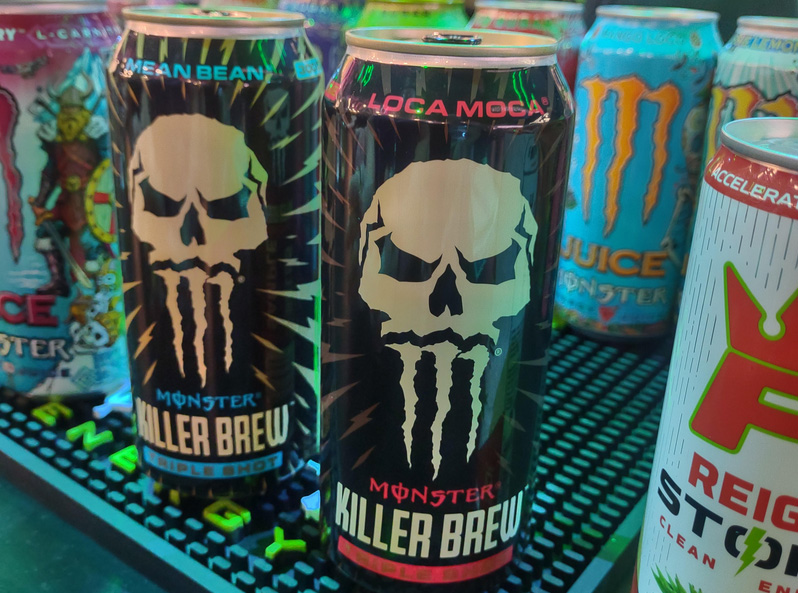

There was a time a decade ago that energy drink marketers testifying before a hostile Congress on Capitol Hill assured their interrogators they would keep their caffeine content at reasonable levels. Then the 300 mg Bang Energy roared onto scene to create new "performance energy" segment and the resolve of most major brands besides Red Bull seemed to erode from what now seems quaint period of restraint. Now, even as it seeks to resuscitate the Bang Energy brand it acquired out of bankruptcy and markets its own Bang rival Reign and a Java Monster Triple Shot at 300 mg each, Monster Beverage is adding another high-powered entry to the mix: Killer Brew Triple Shot, sporting skull imagery along lines of hypercaffeinated Death Wish Coffee brand. Due in Jan, new entry boasts similar recipe to co's longstanding Java Monster coffee subline, a booth staffer explained, in Loca Moca and Mean Bean versions that Java Monster users will recognize from that line, tho packaging otherwise contains no reference to Java Monster. It will be line-priced with Java Monster. Staffer noted that graphic treatment with Monster claw protruding from bottom of skull conjures up Punisher comic/movie antihero character. Note that rival brand to Java Monster, Starbucks-branded coffee/energy hybrid from PepsiCo, offers caffeine dosage of 165 mg per 11-oz can for its own Triple Shot entry. (We'll have more on Monster at NACS in coming issue, readers.)

Flush with $25 mil in funding in just a year, Lucky Beverage continues to make headway building out a DSD network for its Lucky Energy Drink, notching 50 contracts in past 5 months, mainly Bud houses, founder/CEO Richard Laver told us at arresting "Lucky Air" NACS booth outfitted with stylish aeronautical references like a fuselage and departure board in reference to Laver's fortunate survival at age 12 of plane crash that killed 136 passengers and crew. Polar Beverage in New England just signed, and Big Geyser in NY will be coming on next, among 4 other imminent signings. Thanks to recruitment in Feb of Liquid Death cofounder Hamid Saify as CMO, co has been churning out content that's already built a base of 250K TikTok followers, broadening the Liquid Death approach to tell a deeper story than Liquid Death typically does in its astounding marketing stunts. Tho he's awash in capital, Laver vows to dispense it carefully despite building a "super team, super fast" with alums of Liquid Death, C4 and Vitaminwater. He aims "to build a great business, not just a great product. We're a better Liquid Death." As for the pivot from launching as Lucky F*ck to just being Lucky now with the F*ck taped over in can graphics, that created some noise - and a bit of backlash, Richard allowed - but he claims he always planned to move on. (Early investor deck bears no mention of that, so he may have kept that plan to himself in back of his mind.) Tho the brand tested in 19.2-oz can, it now goes out in conventional 16-oz carrying "new school" payload of 200 mg of caffeine enhanced with maca, ginseng and beta-alanine. Staffers dressed as airline attendants were industriously creating Lucky-based cocktails for "passengers" at NACS booth.

Throwback Thursday

This week in 2004, Miller prexy Norman Adami assured IL distrib mtg that Miller will "live up to the full spirit" of new relationship with them and assured co "will stay very clear about the difference between the baby and bathwater." Insisted Miller had "no desire to tamp down" value of distribs' biz or "assert more control" over them. To illustrate those points, he shared a list of "Sure-Fire Methods for Alienating a Beer Distributor." Among his insightful serious/partly humorous thoughts: "Wave the contract in the distribs face every time there's a disagreement." His point: brewer-distrib relationship gotta be based on "commitment and trust" not "enforcement." Also: complain about execution, "particularly when one of your brands is tanking." Brewers gotta provide "pull" for brands and distribs gotta "push" 'em thru with better execution. Also, end of the "Zig and Zag." Norman noted Miller over last 10 yrs has "inflicted no fewer than 7 'turnaround strategies.'" Oscillation was over, Miller will stay focused, Norman vowed.

High Life Gets Free Air Time with VP

During an appearance Tuesday night on the Stephen Colbert show, VP Kamala Harris drank a Miller High Life at the hosts prompting. "Elections, I think, are won on vibes because one of the old saws is they just want somebody they can have a beer with," said Colbert. He then disclosed he checked with Kamala and her team ahead of time to see if it was ok. and she chose Miller High Life. "The Champagne of Beers," said Kamala after she sipped and Colbert noted brand comes from "the beautiful city of Milwaukee." Lots of media picked up story. And no, it wasn't lost on most folks that Miller High Life comes from a key swing state. If Kamala wins the White House, she would be first President in 8 yrs who drinks alcohol.