Beer Marketer's Insights

Is the non-alc beer segment ready for a celebrity-fronted brand? That's what entrepreneurial group is betting as they've made the rounds of beer wholesalers in recent weeks trying to enlist commitments for launch in coming weeks. Tho details are scarce, word has trickled out from the pitches that the brand name is Bero and the celeb is Tom Holland, the exceedingly popular British actor, age 28, whose credits include Spider-Man. It's got a crisp founding story given that Holland notably gave up alcohol in Dry January 2022 after feeling he was too dependent on it in social situations. Its backers include IMGN Ventures, with leadership team including seasoned bev hands led by John Herman, who led buildout of Nutrabolt's C4 Energy RTDs and one of his righthand men on sales, the beer vet Declan Duggan. Leading marketing is Jackie Widmann, who jumped aboard earlier this year after coupla years in innovation roles at Anheuser-Busch. We'd reported on some of those moves, tho venture has been operating in stealth mode shrouded in secrecy aside from NA-beer orientation. Holland's own entrepreneurial ventures seem to have been limited to pair of restaurants so far, along with usual array of product endorsements. Some wholesalers have been buzzing about project and while Herman declined to comment, we're assured more info will be released in coming days. (This article appeared first in sibling pub Beverage Business INSIGHTS.)

STZ Brought On E. Yuri Hermida as EVP, Chief Growth & Strategy Officer; CMO Beer Matt Lindsay Left

Constellation went outside co to hire new exec veep, chief growth & strategy officer, E. Yuri Hermida, reporting directly to ceo Bill Newlands. He succeeds Mallika Monteiro who in Dec became exec veep, managing director of beer brands with "expanded responsibility for beer marketing," in addition to her role as chief growth and digital officer. Mallika continues as exec veep and managing director, and "is responsible for all aspects of brand marketing and advertising, trade marketing and merchandising, as well as field, lifestyle, and experiential marketing for the company's high-end beer brands." She also reports to Bill.

Tilray reported revs up $23 mil, 13% in its fiscal first qtr Jun-Aug. But its beverages jumped $32 mil, 132%, because of its acquired volume from AB. Those brands were still all incremental in qtr. That meant its other bizzes down approx $9 mil, 6%. Beverages jumped from 13% to 28% of revs. Meanwhile, Tilray still losing a lot of money, even if less than a yr ago. It reported a net loss of $34.6 mil, compared to a $55.9 mil loss in first qtr last yr. Tilray well below consensus analyst expectations on several measures, including "a meaningful topline miss," wrote Bernstein's Nadine Sarwat. Alcohol revs 13% behind consensus expectations of analysts and cannabis revs 18% behind. Stock down 3% or so at presstime and down nearly 30% yr-to-date.

Beer Prices Up 3.5% in Sep

Beer prices once again outpaced general inflation in Sep. Consumer price index for beer rose 3.5% in Sep vs yr ago following increases of 3.6% in Aug and 4% in Jul. CPI for all items increased 2.4% in Sep vs a yr ago. That was 0.1% ahead of consensus estimates. CPI for spirits was up just 0.1% in Sep vs yr ago and has grown less than a percentage point for each of last 6 mos. Wine prices were up a modest 0.6% in Sep vs yr ago. YTD thru Sep, CPI for beer up 3.1%, just ahead of 3% increase in general inflation. Spirits prices up 0.7% YTD while wine prices grew 0.8%.

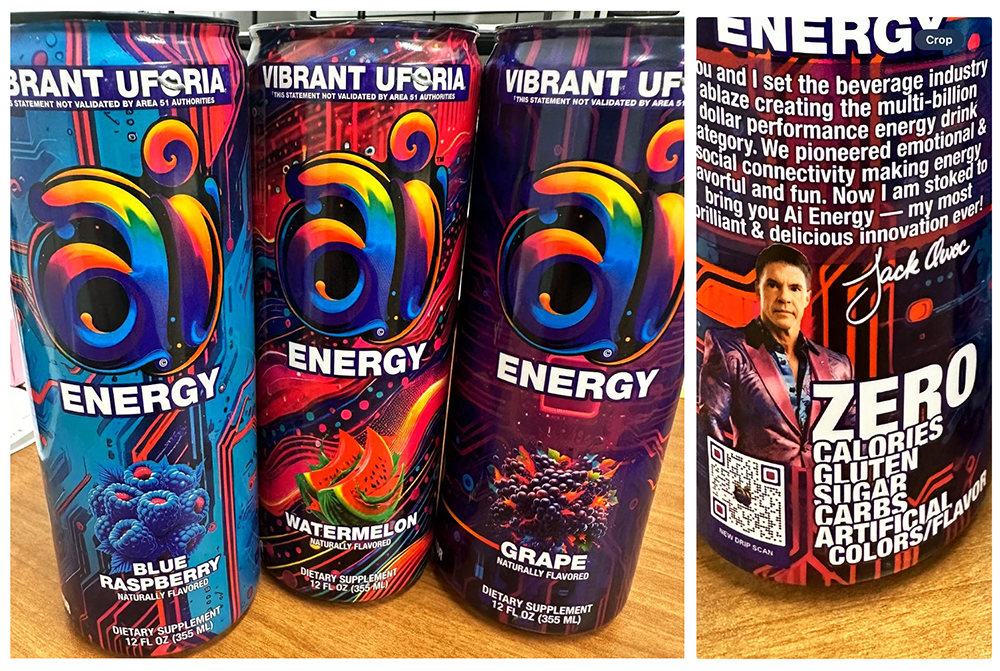

In recent days it's been creating a ripple of shock as well as anticipation: beleaguered Bang Energy creator Jack Owoc, who lost his co to Monster Beverage after series of adverse lawsuits, seems to be looking to re-enter category. The vehicle is new canned energy line called AI, as in "artificial intelligence," that is packed in vibrantly colored 12-oz cans and positioned as "Vibrant Uforia," per prototypes we've viewed. In a nod to his past run-ins with regulators and rivals, the cans also carry tongue-in-cheek disclaimer that "this statement not validated by Area 51 authorities." Owoc, who's built visible social media identity over the years touting Bang and attacking foes, incorporates his own image and signature on back panel, heralding his role in creating the performance energy segment and declaring AI to be "my most brilliant and delicious innovation ever!" The line seems headed to market in Blue Raspberry, Watermelon and Grape flavors and, as one source we encountered at show told us, seems to be receiving surprising degree of interest from distributors, given their past history with unpredictable entrepreneur. We haven't been in touch with Jack yet on this one but hope to bring you more soon.

Zico Coconut Water said it's recruited Seattle Seahawks wide receiver DK Metcalf as an investor and endorser. He joins roster that notably includes tennis star Naomi Osaka, as well as NBA's Malik Monk and MLB's Taijuan Walker. There have been recent additions inside the co too, recall, with recruitment of Chamberlain Coffee CEO Chris Gallant as new CEO.

Is the non-alc beer segment ready for a celebrity-fronted brand? That's what entrepreneurial group is betting as they've made the rounds of beer wholesalers in recent weeks trying to enlist commitments for launch in coming weeks. Tho details are scarce word has trickled out from the pitches that the brand name is Bero and the celeb is Tom Holland, the exceedingly popular British actor, age 28, whose credits include Spider-Man. It's got a crisp founding story given that Holland notably gave up alcohol in Dry January 2022 after feeling he was too dependent on it in social situations. Its backers include IMGN Ventures, with leadership team of seasoned bev hands led by John Herman, who'd led buildout of Nutrabolt's C4 Energy RTDs and one of his righthand men on sales there, the beer vet Declan Duggan. Leading marketing is Jackie Widmann, who jumped aboard earlier this year after coupla years in innovation roles at Anheuser-Busch. We'd reported on some of those moves, tho venture has been operating in stealth mode shrouded in secrecy aside from NA-beer orientation (BBI, Jan 30 and Jun 18). Holland's own entrepreneurial ventures seem to have been limited to pair of restaurants so far, along with usual array of product endorsements. Some wholesalers have been buzzing about project and while Herman declined to comment, we're assured more info will be released in coming days.

Canopy Growth said it's completed acquisition of Wana, putting its extensive line of new Delta-9 THC bevs and ecomm platform entirely under the corporate roof. Wana, recall, recently launched Wanderous ecomm marketplace to carry D9 bevs and CBD gummies of brands like Wana, Cann, Happi, Charlotte's Web, Martha Stewart CBD and MXXN as well as its own Wana Beverages infused line (BBI, Aug 23). As part of this launch, Wana introduced its new line of Wana Beverages, ready-to-drink infused sparkling beverages that combine hemp extracts, real fruit juice, and other beneficial ingredients, offering consumers a new and highly sessionable way to experience Wana products. With Canopy having garnered control of Lemurian Inc and its Jetty vape and extract arm in Jun, it will move to establish joint sales force with Wana "focused on category dominance across the edible and vape segments."

The scanner numbers have looked bleak over past year as drastically downsized Kitu Life Super Coffee portfolio cycled its fuller lineup. But for those who look beneath the hood, the picture has been far more encouraging, cofounder/CRO Jake DeCicco told us at NACS yesterday: within continuing retail footprint sales have been growing by 28%. And it's not all been about subtraction at Anheuser-Busch-aligned co: its 15-oz energy line dubbed Xxtra has performed well and at show it intro'd a new entry dubbed Protein+ that's been tuned to offer GLP-1 weight-loss drug users a way to maintain their muscle mass with robust 25 g payload of protein embedded in thermogenic formula.

NACS: Danone's Stok Offers Aggressively Branded Canned Cold Brew Energy Line with DSD Still TBD

Danone, which has established its Stok brand as a leading player in multiserve cold-brew segment, is venturing a shelf-stable canned energy line that may or may not be made available to DSD distributors. At big Stok booth, the company was sampling Stok Cold Brew Energy, an 11-oz line boasting 195 mg of caffeine along with B-vitamins, guarana and ginseng. With 21 g of sugar, it's indulgent offering, coming in at 140 calories per can. Initial flavor lineup of Caramel Cream, Mocha Cream and Vanilla Cream is packed in cans sporting aggressive animal imagery and on-pack assurance that items "support focus." SRP is $4.29. New line is breaking now exclusively at 7-Eleven thru year-end, followed by broader rollout. Booth staffers said that internal debate is proceeding on whether to recruit DSD partners for brand beyond smattering currently in the mix, such as Instrastate in Detroit. "We're waiting for the green light" on developing more national footprint, one exec told us, saying she couldn't yet hazard a guess as to which way the decision will go given complex tradeoffs.